Why Your Agency Needs a CRM for Insurance

Whether you’re a broker, an independent insurance agent, or need feature-rich customer relationship management (CRM) software for your team, the best CRM solution can be the key to business growth. Read on to discover how you can make the most of insurance CRM to grow your company.

CRMs in Insurance

An insurance CRM software automates and simplifies the entire insurance workflow. It eliminates data entry and the need to carry physical case folders, letting insurance agents use their time more effectively.

Insurance CRMs also help insurance agencies automate and assign tasks to the right people, organize their leads and claims, and manage multiple policies in a single system.

Why You Need an Insurance CRM

Here are three reasons why the adoption of CRM software can be essential for businesses that sell insurance:

1. Competition in the Insurance Industry Has Skyrocketed

The U.S. insurance market is one of the largest globally, leading the sector with high premium volumes, insurance company revenues, and employee numbers. As of 2020, insurance premiums in the U.S. reached over $1 trillion.

Undoubtedly, competition will continue to increase in this lucrative sector. And that's precisely why insurance brokers and agents should be more efficient and effective than ever before.

A CRM solution can help you stand out in this competitive industry. It makes it so you can focus more on addressing customer needs by offering contextual communication, exceptional customer experience, and resolving claims quickly.

2. An Insurance CRM Helps You Build Customer Trust and Confidence

You can create a trusting relationship with potential customers in two ways: spend fortunes on radio, TV, and newspaper advertising or build relationships with them. For the latter, CRMs are the perfect solution.

Avoid spending a fortune on ads and reliably engage prospects using CRM software. It’ll help you nurture better customer relationships, resulting in myriad benefits for your business.

3. Most Insurance Companies Use CRM Software

Grand View Research shares that over 91% of companies with more than ten employees use CRM systems. If your insurance agency falls within that range, consider adopting a CRM system to avoid being left behind.

Using CRM software will help you centralize all client information and automate processes to make your insurance agents more efficient when contacting current and potential clients.

Top-Rated Free CRM Software for Your Whole Business

Think CRM Software is just about contact management? Think again. HubSpot CRM has free tools for everyone on your team and it's 100% free.

What Are the Features of an Effective Insurance CRM?

Buying any CRM software won't help you become more efficient or grow your small business. Instead, you must ensure that the CRM platform is suitable for your business needs.

Here's a list of CRM features that make CRM software effective:

Workflow Organization

CRM software can significantly impact workflow organization by centralizing all customer interactions. With its help, you no longer need different platforms to track phone calls, emails, and other client-agent exchanges.

This client management tool also helps insurance agents stay organized and on top of every aspect of the sales process so that nothing falls through the cracks.

By consolidating customer data from various sources and presenting it in a single place, CRMs for insurance help agents make better business decisions.

Seamless Lead Capturing

An effective CRM should integrate all communication channels in your lead management strategy effortlessly.

With leads coming from all over — social media, website inquiries, phone calls, referrals — it should capture every inquiry without any leakage. CRMs help you set up an organized approach for reaching out to these prospects by bringing these channels to a single dashboard.

Automatic Lead Distribution

An effective CRM software can help you distribute leads automatically based on the type of policy the prospects are interested in, agent availability, geography, or any other logic that complements your processes.

That not only reduces manual effort but also increases the chances of conversion.

With a CRM for insurance agents, your team can work on leads in real-time and move them down the sales funnel.

Lead Prioritization

A CRM platform should help you prioritize each lead according to its importance. For example, you can prioritize leads based on specific financial characteristics, those from a particular source, or any other set logic that’ll offer maximum value.

Knowing where to put your efforts first is critical if you want to boost your sales, and an effective CRM tool can help you do so.

Mobile-Friendliness

The best CRM software solutions should be mobile-friendly because mobile apps are growing in popularity. Statista estimates that mobile app revenues will increase over the next few years and reach around $613 billion by 2025.

With most insurance agents often on the go, implementing a CRM that has the same functionality on a mobile phone as it does on the web will help your agents engage prospects wherever they are.

Analytics and Report Generation

An insurance CRM software should provide analytics and generate reports for trends, performance, and customer behavior monitoring.

It should also have a user-friendly dashboard that accurately summarizes all the important information and helps you get quick insights into your sales and marketing performance.

Whether you’re in the health, auto, or life insurance business, a CRM software that uses predictive analytics to help your team identify customers at risk of churn is invaluable.

What Are the Benefits of CRMs for Insurance?

Here are some ways a CRM solution can benefit your insurance agency:

More Productivity and Efficiency

The best CRMs focus on nurturing customer relationships while making your company more efficient and productive through automation and targeted data.

In lead generation, CRM software can help you set specific parameters to categorize potential leads and design targeted marketing campaigns for each group. Your team can also get a detailed analysis of which leads are more likely to convert.

You can also schedule email marketing campaigns and send them through the CRM, freeing your team to focus on other areas that'll help convert potential leads into sales.

Centralization of Customer Data

CRM software helps you centralize all customer data in a single system that can be accessed by any team member anytime. That includes basic info such as client names and contact information.

It can also record previous customer interactions with agents and sales teams, offering policyholders exceptional customer service.

Enhanced Customer Data Security

Modern insurance CRM tools have built-in data security measures. Insurance agents must also follow various security protocols to access or change client data.

With the right insurance CRM software, there's almost no risk of unauthorized access or data manipulation.

Effective Lead Management

Your CRM's lead management function can notify your insurance agents when they should reach out to potential leads through email or phone.

You can also schedule and automate email campaigns via the dashboard and track all lead interactions to ensure you don't overlook any prospects.

Helps Build Better Relationships With Clients

A CRM system maintains updated client lists with detailed personal information, demographic tracking, previous business dealings with customers, and other necessary data.

As a result, you'll always have all the client data you need to ensure customer satisfaction and improve customer relations.

CRM software can also automate some customer service tasks so that clients don’t have to wait for long periods to be served when they contact your company.

Streamlines Services by Segmenting Customers

CRM tools automatically segment your client list into categories such as gender, location, and buyer stage. That helps you avoid going through a lot of information when sending group emails, making it easy to determine which emails to send to which clients.

Boost Revenue and Sales

CRM solutions help insurance companies boost their sales and revenue by streamlining the sales process through automating critical, time-consuming tasks and analyzing sales.

It also allows agents to identify key industry trends to predict future sales. As a result, they can study those reports and adjust their operations to make sure they achieve their goals.

Taking a systematic approach to marketing also involves sales. With HubSpot, this is clear. It’s all one. Online marketing means online sales

Mark Möller

Managing Director

IDEAL Vorsorge

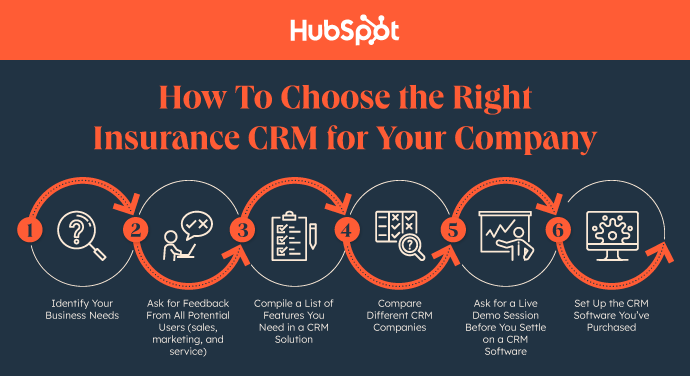

How To Choose the Right Insurance CRM for Your Company

Before choosing a CRM provider, you should consider various factors such as features, pricing, ease of use, and your business goals.

You don't have to go with the most advanced CRM on the market. Instead, choose a provider who best meets your business' needs and aligns with your budget and priorities.

That said, follow the steps below to know which CRM is right for your business:

Identify Your Business Needs

List the company challenges you want to solve to determine which CRM features and modules will be helpful.

Consult your customer service and sales teams to learn about their experiences with customer relationships and customer data. That’ll help you understand how a CRM can simplify their work and improve sales.

A CRM system can help you become more successful when you have clear business goals.

Ask for Feedback From All Potential Users

While the insurance sales team are the primary users of a CRM system, it's important to ask for feedback from all potential users, such as the marketing and service teams, to determine if it'll benefit the whole team.

For example, if your accounting, marketing, and customer support departments will be using the new CRM software, their feature requests will most likely differ from those of your sales agents.

Compile a List of Features You Need in a CRM Solution

After you've identified your business goals and asked for feedback from various teams, compile a shopping list of relevant CRM features.

Ensure the CRM software keeps your data safe with advanced user permissions and two-factor authentications. Other CRM features to look out for include marketing and sales automation, lead tracking, and contact management for monitoring marketing campaigns and sales activities.

It must also have reliable customer support that you can easily access from multiple channels. Choose a provider that offers email, phone, and live chat support to get technical assistance whenever you need it.

Compare Different CRM Companies

When comparing CRM providers, consider the features they offer and how customer-centric and data-driven each one is.

Find out which software will save you money by integrating with your existing marketing automation providers, task management systems, and other third-party software-as-a-service (SaaS) platforms that enhance the CRM's customization and functionality.

Also, choose a CRM tool with features that grow with your insurance business. Or a CRM you can upgrade to a more advanced version should your agency need future changes.

Here are three ways to narrow down your options and decide which CRM tools to test drive:

- Read online and print publications related to your business to understand what CRM software is popular in your industry.

- Ask friends and other business owners what CRM they use and if they’re satisfied with it.

- Check out existing online reviews from customers.

Ask for a Live Demo Session Before Settling on a CRM Software

Most CRM providers offer free trials to potential clients to try the software before buying. An ideal free trial should give you access to all features and enough free trial days to get a complete sense of the product.

Form a trial team of members from different departments that might use the CRM to maximize the free trial. That way, you can collect comprehensive feedback from the end-users — whether they’re in marketing, sales, or customer service.

Set Up the CRM Software You’ve Purchased

After purchasing a CRM that suits your business needs, set it up in a way that’ll be most beneficial to your team.

You can get all the data your team needs from your old CRM, sales emails, or spreadsheets, then integrate it into the new CRM to track future communications between your team and customers.

Grow Your Insurance Company with a CRM

HubSpot CRM offers forever-free plans for its Sales, Marketing, and Service Hubs. As your insurance agency grows, you can upgrade to a premium version with more features.

Build a Foundation for Growth With the best CRM for the Insurance Industry

Scale quick, stay lean. Bring your teams together with HubSpot’s CRM for insurance.

Frequently Asked Questions

-

A CRM system helps you manage customer data. It supports sales management, integrates with social media, delivers actionable insights, and facilitates team communication.

-

The ultimate goal of CRM and related CRM systems is to manage and improve business relationships efficiently.

-

Customer touchpoints are your company's points of contact with customers.

Customers may discover your business online or through an ad, shopping at your retail store, reading ratings and reviews, visiting your website, or contacting your customer service.