Partner Stories

StartEngine & PopCom: A Partner Profile

Partner Stories

Dawn Dickson faced obstacles on a few fronts when raising capital for her business PopCom (a.k.a. Solutions Vending International). PopCom is at the forefront of retail with its automated technology platform for vending machines and kiosks that allows retailers to engage and understand customers, sell more products, and learn from big data.

Dawn doesn’t fit the Silicon Valley CEO stereotype, and she struggled to find investors. “It was very challenging in the beginning to convince investors that this was a viable, growing market. But I needed substantial capital to grow the business,” says Dawn.

Crowdfunding investment platform StartEngine, empowered Dawn, and other founders like her, to find the funding they need, as well as build community. We spoke with Senior VP of Fundraising, Josh Amster, and Iñaki Pedroarena-Leal, Head of Partnerships, as well as Dawn herself, to learn more about how StartEngines help founders' investment dreams come true.

This lack of access to capital—and the inherent biases in many funding decisions—is something many founders experience. They can’t secure funding without the right connections. And if they do get funding, it comes with strings attached.

Iñaki Pedroarena-Leal, Head of Partnerships at StartEngine, has witnessed these inequities. “There are hundreds, if not hundreds of thousands, of startups that aren’t serviced. They’re good companies with good ideas. But for one reason or another, they don’t have access to the capital they need to grow, and so many cease to exist or fail to become the next big thing that changes the world.”

“There are hundreds, if not hundreds of thousands, of startups that aren’t serviced. They’re good companies with good ideas. But for one reason or another, they don’t have access to the capital they need to grow, and so many cease to exist or fail to become the next big thing that changes the world.”

— Iñaki Pedroarena-Leal, Head of Partnerships

Iñaki Pedroarena-Leal, Head of Partnerships

Iñaki Pedroarena-Leal, Head of Partnerships

Securing financial capital has long been a stumbling block for founders. Until recently, every source of capital came with significant drawbacks, whether banks, angel investors, accelerators, or venture capital firms (VCs).

Banks are the most obvious source of capital, but that capital comes in the form of debt, which shackles the hands of founders. Whenever founders acquire debt, a portion of any money earned has to pay back a portion of that capital, plus interest—right when startups need to put every penny back into the business. “Debt can strangle early-stage startups,” says Josh. “It’s a big reason why many startups die or can’t grow as fast as they want.”

Angel investors are another potential source of funding for founders, but their resources are limited. “Angel investors don’t have unlimited access to capital,” says Josh. “So just when you’re ready to grow your business, your angel might not have any more money to put in.”

Additionally, angel investors may not have the right strategic connections to help the startup grow. “Sometimes, the person is a nightmare to work with or they can’t open the right doors,” says Josh.

Dawn Dickson was able to secure a round of funding for PopCom through an accelerator program, but that’s not an option for every startup. Not only is the competition stiff, accelerators can also be costly. Typically, accelerators demand a percentage of a startup’s equity as the price of admission.

Some founders get funding from venture capital firms. VCs, however, tend to have strong ideas about the companies they invest in and want a return on their investments as soon as possible. “Some companies go the VC route, and it’s the best thing ever,” says Josh. “Others have bad experiences with VCs and swear they’ll never do it again.”

Working with a VC also means giving up control because the investor sets the terms of the agreement. “Many founders don’t want an outsider dictating the vision or telling them what to do,” says Josh.

Iñaki agrees: “For many founders, it’s important to stay in control of their company and set their own terms and valuation.”

“For many founders, it’s important to stay in control of their company and set their own terms and valuation.”

— Iñaki Pedroarena-Leal, Head of Partnerships

For the longest time, founders had few other funding options other than those listed above. But in 2015, new SEC regulations permitted companies to offer and sell securities through crowdfunding.

StartEngine launched soon after, becoming a crowdfunding pioneer.

Instrumental to StartEngine’s success was “Mr. Wonderful”—entrepreneur and Shark Tank television personality Kevin O’Leary. He signed on early as a strategic advisor, investor, and spokesperson for StartEngine.

Kevin O’Leary found his first big success with SoftKey, an educational software company. After years of ups, downs, sacrifices, and lessons learned, SoftKey was acquired for $4 billion.

After this extraordinary success, Kevin became a sought-after host and personality, appearing on Discovery’s Project Earth, CNBC, and ABC’s Shark Tank. In 2014, Kevin founded O’Leary Financial Group—a group of brands and services that share Kevin’s guiding principles of honesty, directness, convenience, and value.

StartEngine first connected with Kevin when it reached out to him to see if he might become a spokesperson. StartEngine discovered that Kevin was very familiar with the crowdfunding space and excited about the opportunities it presented. In fact, he was contemplating getting into that space himself.

Once Kevin saw StartEngine’s trajectory and met its leadership team, he decided to join StartEngine instead of starting his own company. “He was an early investor in our business and became a paid spokesperson,” says Josh. “He’s been instrumental in our growth. He talks about us on CNBC and has his own portfolio of companies that raise capital on StartEngine. He's really been a great ambassador for us in getting the word out about equity crowdfunding and StartEngine in particular.”1

“Kevin O’Leary was an investor in our business and became a paid spokesperson. He’s been instrumental in our growth. He talks about us on CNBC, and he has his own portfolio of investments and companies that raise capital on StartEngine. He's really been a great ambassador for us in getting the word out about not only equity crowdfunding, but StartEngine in particular.”

— Josh Amster, Sr. VP of Fundraising

Josh Amster, VP of Fundraising, StartEngine

Josh Amster, VP of Fundraising, StartEngine

Want to see more of Dawn's story? Then be sure to tune into season 2 of Spiraling Up: The Journey to Become a Unicorn. This documentary series between HubSpot for Startups and LinkedIn follows the stories of a diverse group of founders all striving to achieve that elusive of business goals, unicorn status. Dawn will be one of the three founders featured in season 2. Use the button below to see season 1, and sign up for updates.

Since those early days of crowdfunding, other platforms have emerged, such as Kickstarter, Indiegogo, Funding Circle, and GoFundMe. Each of these platforms serves a different purpose.

Kickstarter, for example, is a rewards-based platform. Kickstarter campaigns raise capital through the presale of a product or perks to attract fans and customers. Once the Kickstarter “investor” receives their product or perk, the contract with the company is complete.

Josh explains: “If you want to bring a new camera or T-shirt to market, you can use Kickstarter to raise money to fulfill that product. But if you want to start a camera or T-shirt company, you can launch an offering on StartEngine, raise money from the general public, and use that money however you need in order to grow.”

Indiegogo is similar to Kickstarter but focuses on the tech space. Again, the relationship between the investor and the company comes to an end once the product is fulfilled.

Other platforms, such as Funding Circle and LendingClub, are Peer-to-Peer (P2P) lenders that work with multiple investors to fulfill loans. Loans must be repaid, and they can have higher interest rates and fees than traditional bank loans.

GoFundMe is a donation-based crowdfunding platform that’s mostly used for charitable initiatives. Any funds given by “investors” do not have to be repaid.

StartEngine is different. Investors on the StartEngine platform take equity in the companies they invest in, giving them an inherent interest in the success of those companies. With skin in the game, investors are motivated to promote and support those companies over the long term.

Founders that want to crowdfund on the StartEngine platform have two paths to choose from: Regulation Crowdfunding and Regulation A+.

With Regulation Crowdfunding, companies can raise up to $5 million each year through its funding portal, StartEngine Capital LLC. They can launch in about four to six weeks with little or no upfront cost.

Generally, companies raise for 60-90 days but can continue to raise for one year and beyond. Offerings must be live for a minimum of 21 days.

Business owners can self-certify their financials with Regulation Crowdfunding, up to $107,000.

With Regulation A+, companies can raise up to $75 million each year through StartEngine’s broker-dealer, StartEngine Primary LLC. Average launching costs on StartEngine are about $50,000-$75,000 and usually takes three to five months to complete.

Companies generally raise for six months to a year although they can choose to raise for up to three years.

Both paths require companies to disclose basic legal documents, such as Articles of Incorporation and Board Resolution, as well as information about the business and its executives.

Regulation A+ raises require a full two-year financial audit. If a raise is successful, ongoing requirements apply, such as filing reports with the SEC.

Companies must apply to fundraise on StartEngine. StartEngine reviews every application to make sure they meet compliance requirements.

Today, crowdfunding through the StartEngine platform constitutes an entirely new source of financing for growing companies without the drawbacks of traditional funding sources.

When crowdfunding on the StartEngine platform, founders get to set the terms of the investment agreement, from valuation to share price to type of stock issued. “It’s a way to raise capital that gives founders full control to take their company in any direction they want,” says Iñaki.

Not only do founders get to set their own terms, StartEngine’s crowdfunding platform also gives founders a way to reach new investors without biases or a lack of business connections getting in the way.

“You feel like you’re making a really big difference for that entrepreneur by helping them get access to capital, especially ethnic groups that don’t fit the traditional VC model and are unfairly passed over. Helping those entrepreneurs and getting them access to capital is really rewarding.”

— Josh Amster, Sr. VP of Fundraising

Iñaki agrees: “The whole point of equity crowdfunding is that the crowd gets to decide what they want to support, not VCs or angel investors.”

StartEngine also gives the average person the chance to invest in new companies. “These people want to invest in startups but never had the opportunity prior to equity crowdfunding. Now they can. They can invest $100, $1,000, $20,000 or whatever they want as part of a well-rounded portfolio,” says Iñaki.

Iñaki sees the potential for these new opportunities to change lives. “Investors are able to invest in early-stage startups, something that has traditionally been reserved for the super wealthy and accredited investors,” says Iñaki. “Now, they might invest in the next Uber before it becomes Uber or the next Facebook before it becomes Facebook. That’s the whole point.”

“Investors are able to invest in early-stage startups, something that has traditionally been reserved for the super wealthy and accredited investors. Now, they might invest in the next Uber before it becomes Uber or the next Facebook before it becomes Facebook. That’s the whole point.”

— Iñaki Pedroarena-Leal, Head of Partnerships

StartEngine actively promotes the investment offers available on its platform. It has its own internal digital ad agency that customers can use for help with marketing strategy and campaigns, including social media, TV and other outlets. The average ROI is 417%—and can climb as high as 1000%! “We run ads, send out newsletters, and notify media outlets. We also post updates to our community of 800,000 plus prospective investors,” explains Iñaki.

This advertising and promotion often drives an increase in sales. “It’s a really nice way to not only raise capital but also increase your revenue as a byproduct,” says Josh.

StartEngine also provides companies with an account manager to help with legal and financial admin, such as completing and filing required forms.

The StartEngine crowdfunding model of fundraising also gives startups the opportunity to build a community of supporters and advocates. “New relationships come from the equity crowdfunding process,” says Josh. “You turn your fans and customers into investors, and they become brand ambassadors. It builds a really strong connection between the company and their community.”

In the fall of 2020, StartEngine introduced StartEngine Secondary as a way to make offerings on the StartEngine platform even more attractive to investors.

Usually, when investors invest in a startup, their investment is locked in for many years. This lack of liquidity discourages investment. However, with StartEngine Secondary, investors can trade their shares on a secondary marketplace as long as the offering company files the necessary paperwork.2

StartEngine Secondary is one of the first marketplaces of its kind. “Anytime you go on our platform and buy shares in a company, you can go on our secondary platform and trade those shares to get access to liquidity if someone wants to buy them,” says Josh. “This is a really unique and beneficial thing for both companies and investors.”

StartEngine also partners with top service providers, such as HubSpot for Startups, to provide deals and discounts on the tools that startups need the most.

HubSpot was a natural choice as partner because StartEngine itself uses the HubSpot CRM Platform to generate leads and manage referrals. “HubSpot helps us be very strategic in the way we connect and communicate with entrepreneurs,” says Josh. “We deal with hundreds and hundreds of companies and founders, so keeping everything organized is critical. HubSpot is the main reason we can do that.”

Iñaki agrees: “HubSpot is an amazing tool that I use on a daily basis. It’s very important to us.”

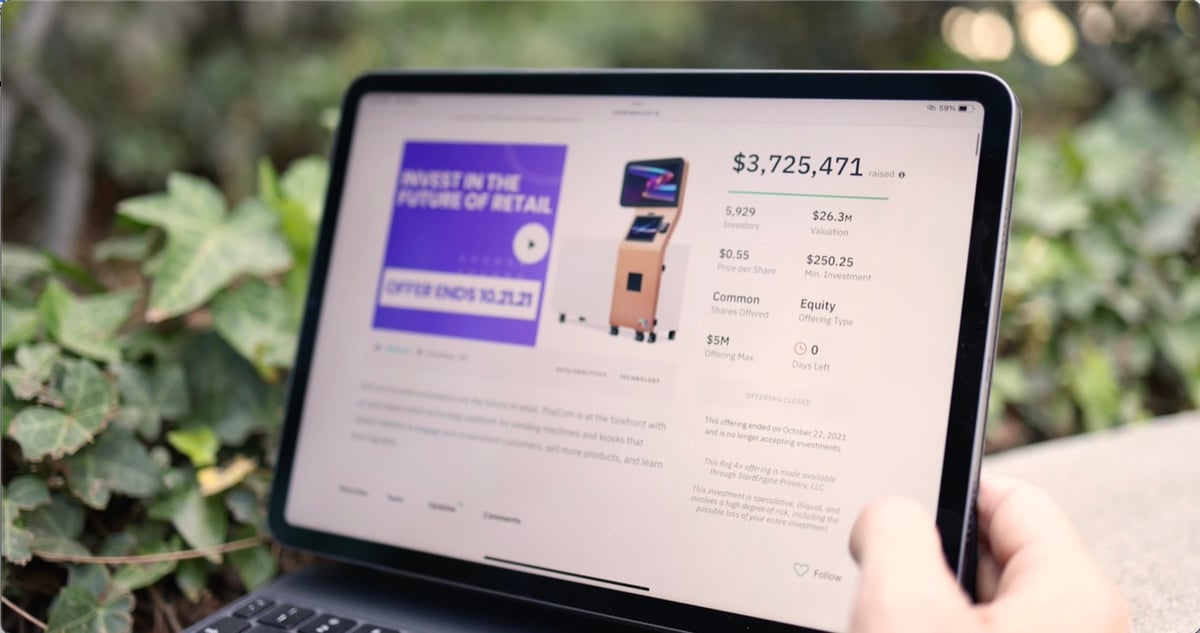

Dawn Dickson raised $6 million for PopCom with StartEngine. “I felt that crowdfunding would be an amazing opportunity to engage our community and supporters to really scale with us and bridge us to the next major round, which is exactly what we did,” says Dawn.

Dawn’s first Regulation Crowdfunding round in 2019 was oversubscribed, raising $2.3 million. She then opened another Reg CF in 2020 that became oversubscribed. In 2021, the company completed a Regulation A+ round, which put PopCom’s crowdfunding total at about $6 million. Today, PopCom has 10,000 investors on StartEngine.

Going the crowdfunding route brought additional benefits to Dawn and her team. “The energy of crowdfunding is a lot more fun than the energy of raising venture capital because people really feel connected. It’s great to have that community and that support,” says Dawn.

Baqua and PopCom are far from the only StartEngine success stories. Others have succeeded at an even higher scale. Knightscope, a security robot company, raised $56 million over three fundraising campaigns. StartEngine itself has raised over $60 million from the crowd.

StartEngine has helped fund over 700 businesses over the last six years and raised nearly $800 million. The platform has over 800,000 prospective investors as part of its community.

Iñaki expects that interest in the StartEngine platform will only grow as more and more founders become aware of crowdfunding as a viable and preferred way of growing their startups. “It’s a great time to fundraise, so get in contact with someone on our fundraising team,” says Iñaki. “You’ll get some valuable insights with no strings attached. You won’t have to move forward with it. But you should definitely look into it. We’ve seen that startups that wait too long to learn more are sometimes too late to fundraise in general.”

“It’s a great time to fundraise, so get in contact with someone on our fundraising team. You’ll get some valuable insights with no strings attached. You won’t have to move forward with it. But you should definitely look into it. We’ve seen that startups that wait too long to learn more are sometimes too late to fundraise in general.”

— Iñaki Pedroarena-Leal, Head of Partnerships

[photos and video by Logra Studio]

Interested in being a partner in the HubSpot for Startups network? Click here

Take a look at the full directory of partners who can help you qualify for HubSpot for Startups. Directory

Disclaimers

1. Disclaimer: Section 17(b) disclosure: Kevin O’Leary is a paid spokesperson for StartEngine. Kevin is paid $400,000 per year for the first three years, then $420,000 in year four, $450,000.00 in year five, and $480,000 in year 6. Kevin has also received compensation in the form of 322,506 options at a $7.50 strike price and 343,282 options at a $40.50 strike price.]

2: A company which intends to be quoted on the marketplace will be subject to certain requirements which the company may or may not be able to satisfy in a timely manner. Even if a company is qualified to quote its securities on the market, there is no guarantee an active trading market for the securities will ever develop, or if developed, be maintained. You should assume that you may not be able to liquidate your investment for some time or be able to pledge these shares as collateral.