Capital funding trends

In the world of startups, financing is everything. Staying ahead of capital funding trends can make or break your business.

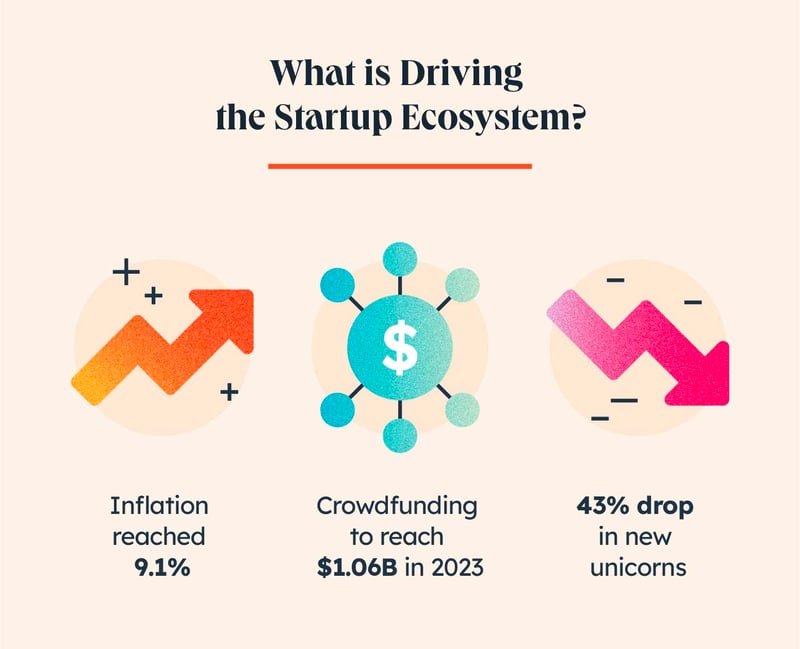

For some time, the meta has leaned heavily toward venture capital, but a new wave of more democratic and conscious funding is taking the market by storm as inflation wreaks havoc on the economy.

Valuation deflation

In 2022, the rate of inflation in the United States peaked at an astonishing 9.1%, forcing the Federal Reserve to take unprecedented action to ease consumer prices.

Why does this matter?

For the past decade, low interest rates have driven remarkable growth, leading to sky-high valuations across every industry in the startup ecosystem. But the era of cheap money has come to an end. The Federal Reserve has scaled up interest rates in a hurry, and now startups that may have received easy funding in the past are scrambling for alternatives.

Higher interest rates have already sparked a 43% decline in unicorns from Q2 2021 to Q2 2022, and the outlook isn’t likely to improve much in the short to medium term. This means that fundraising will be more difficult and more startups will be forced to get creative as they tighten their belts.

Crowdfunding

Crowdfunding has been on the rise in recent years, and it will only become more popular as traditional sources of startup funding dry up. Platforms like Kickstarter, Indiegogo, and StartEngine have already disrupted the startup ecosystem by giving early-stage companies a way to raise money from a large group of small investors. Whereas Kickstarter and IndieGoGo focus on raising money for products sold by a company, StartEngine allows you to crowdfund for capital that can be used across the board, giving funders a stake in the business.

"The total value of crowdfunding campaigns is expected to exceed $1.02 billion in 2022, and increase to $1.06 billion through 2023."

Crowdfunding isn’t an easy solution, however. Over 300,000 Kickstarter campaigns could not meet their goals in 2022, highlighting exactly how competitive this financing path can be.

Non-dilutive funding

Another trend to watch closely is the rise of non-dilutive startup funding sources. This is due in part to the fact that these types of funding don’t require startups to give up any equity in their company, and as valuations return to Earth, every bit of equity that stays within the company is important.

So what is non-dilutive funding?

Non-dilutive funding is a type of startup financing that doesn’t require the startup to give up any equity in the company. There are a few different types of non-dilutive funding, but some of the most popular include grants, loans, and revenue-based financing. Of the three most popular non-dilutive funding options, revenue-based financing is growing the fastest, with an expected CAGR of 61% from 2020 to 2027.

Merger madness

While venture capital financing in the startup ecosystem has declined in 2022, consolidation has been on the rise, with some startups favoring mergers and acquisitions over more traditional funding.

The consolidation trend is particularly interesting given the state of the economy. Typically M&A spending falls in times of economic turmoil; however, the dramatic drop in late-stage funding has left startups looking for alternatives.

This trend will likely continue into 2023, and we could see many more unicorns emerge as a result.

Startup success and failure statistics

Did you know that as much as 90% of startups fail? It’s a pretty harrowing statistic that can be a hard pill to swallow for some entrepreneurs. But don’t get discouraged — the startup ecosystem has exploded over the past decade, with the total post-money market value growing by 239%.

"The total market value for startups has grown by 239% over the last decade."

How startups can succeed in 2023

While the success of a startup depends on an array of different factors, there are a few things many successful startups have in common.

Raising capital is one of the most challenging aspects of building a startup. In fact, out of the 90% of startups that fail, as much as 38% do so because they don’t have the funds they need to proceed.

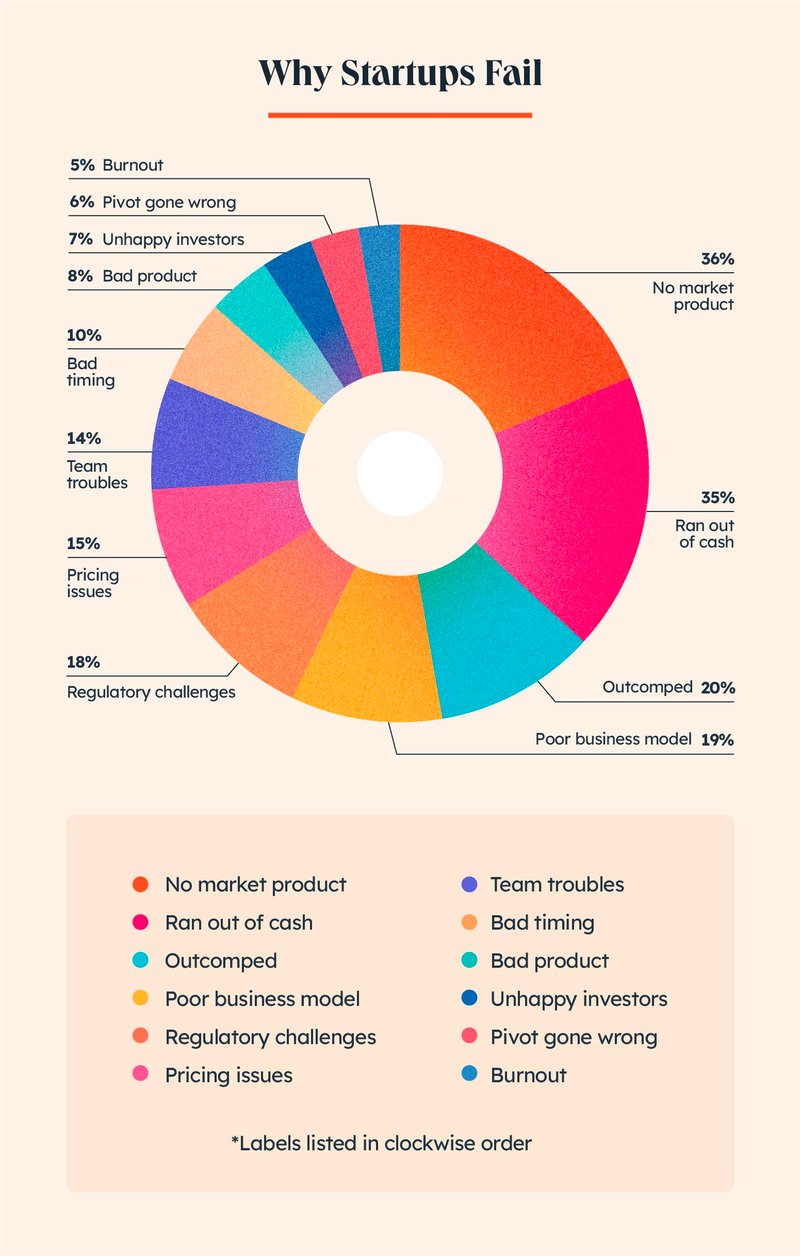

Another contributing factor that could determine a startup's failure or success is having a market for the product the startup is selling. While this may seem obvious to some, as much as one-third of startups fail because there is not a big enough market for their product.

It's also important for startups to have a team of passionate individuals committed to the company's success. A startup is not a one-person show, and it takes a team of dedicated individuals to make a company succeed.

Being aware of why startups have failed in the past can help businesses prepare for the future. As startups continue to grapple with economic headwinds, a clear trend is emerging: companies that built a product with appeal and companies that manage their funds appropriately are most likely to prevail.

Startup costs

Startup costs

Between talent, tech, and marketing, startup costs can add up quickly. And managing them effectively can make or break your business.

Talent and office space

Payroll is a massive expense. In fact, it can sometimes soar past 50% of a startup’s overall expenses.

Startups can expect to pay, on average, $300,500 for five employees across the U.S. in the first year.

Rent comes in as the second most costly expense. This is an area where costs can range drastically depending on where the startup is located. In some parts of the country, a startup may pay as little as $20,000 per year for a 1,000-square-foot commercial space, while in San Francisco or New York City, costs could approach $90,000 or more for the same space.

With rent and personnel accounting for such a large chunk of a startup’s budget, many businesses may opt for hybrid working opportunities or full-on remote schedules. This can help a startup looking to cut costs by reducing office expenses. It also provides additional incentives that may persuade top talent to join the team without necessarily forking out San Francisco payrolls for said talent.

Technology

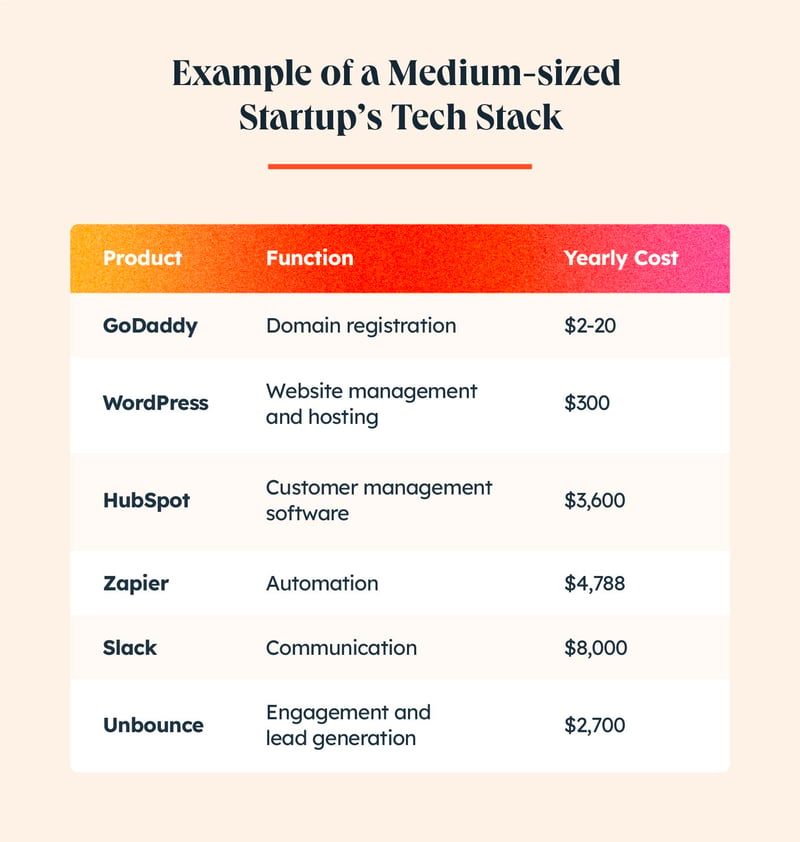

A startup’s technology stack is a key business component that should not be ignored. A startup’s tech stack should include tools that improve efficiency, keep their data safe, and keep customers engaged. But considering the average startup uses between four and ten different tools, these benefits can come at a cost. You can often reduce the cost of your tech stack joining communities like FounderPass.

Here is an example of what a startup might use, why they might use it, and how much it would cost:

Data Sources: GoDaddy, Unbounce, HubSpot, Zapier, Wordpress, and Slack.

Going forward, technology will become an increasingly necessary component in a startup’s arsenal. In fact, the Software as a Service (SaaS) industry is projected to grow from $130 billion in 2021 to $716 billion by 2028.

Marketing

Marketing can be another significant cost for startups, with some businesses spending as much as 11% of their revenue here. But spending on the appropriate platforms is now more critical than ever.

Startups allocate their budget toward different channels depending on their goals and industry, so there’s nothing set in stone on that front. A study from Statista, however, shows that startups across North America and Europe often prioritize social marketing, digital ads, and SEO above all else.

Moving into 2023, many startups operating on tight margins may opt for digital marketing options like email or SEO marketing, which offer ROIs of 3,600% and 2,200%, respectively, while moving away from more expensive and less effective options like paid social media or pay-per-click marketing.

Most promising startup industries

The total value of all unicorns globally is just above $3.7 trillion, with the world’s most valuable, ByteDance, coming in at $140 billion. Those are some big numbers, but it’s important to note that not all startups or startup industries are created equal.

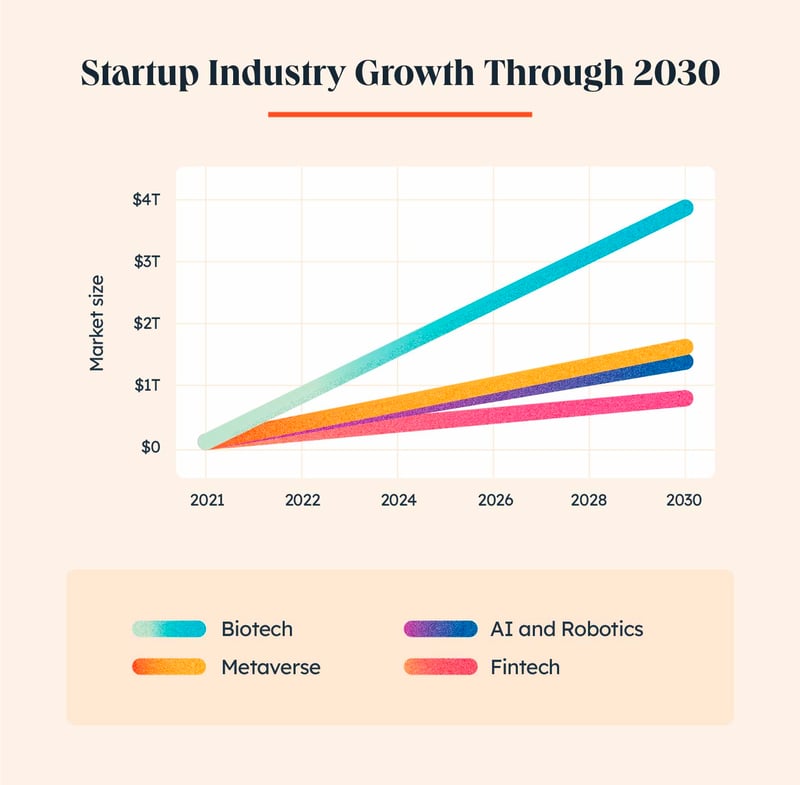

While most unicorns currently reside in the fintech space, biotech and virtual reality startups may just have the greatest potential trajectory.

Fintech startups

Fintech startups

Fintech, or financial technology, uses technology to facilitate transactions, documentation, or trading within the financial sector.

Some examples of fintech firms include Mint, Cash App, and Robinhood.

It’s an industry that has absolutely exploded in recent years, and it’s easy to see why. Fintech makes some parts of the financial world, like trading or transferring money, more accessible and cheaper for the everyday person.

And it’s not just about digital payments, either.

Fintech is a broad category that covers everything from financial health to neobanking and beyond.

Though fintech funding saw a decline in the first half of 2022 as the economic meta The sector still accounted for 21% of all unicorn companies weighed on consumers, suggesting there is still some room to run.

As the global economy continues to struggle, consumers will likely double down on alternative banking, fee-free trading, and other financial technology services that help them optimize their finances. While it may not see the growth that some other sectors might, it’s still projected to be a near-$700 billion market by 2030.

Artificial intelligence startups

Artificial intelligence is another massive industry in the startup ecosystem, with the market expected to reach a valuation exceeding $1.5 trillion by 2030. And if the explosive growth of Open AI's ChatGPT has shown us anything, is that you can expect AI to play a huge role in research, content development, marketing, and other business initiatives. (Expect to see more companies like Jasper and Lensa hit the scene).

Since 2017, the AI blockchain industry saw the most significant growth in funding, climbing by more than 90%, while robotics came in a close second, with funding soaring by as much as 70% in the same time.

While funding may have slowed, AI technology is here to stay as its importance in our daily lives continues to grow. And ByteDance, the world’s highest-valued startup, proves just that.

While you may know the behemoth known as ByteDance for its extremely popular TikTok app, it’s actually a massive AI play. Why, exactly? Well, ByteDance isn’t just TikTok. The company also owns some of China’s other top social media brands and content platforms.

Through all of its platforms, ByteDance collects an incredible amount of data, and uses it to provide personalized content to its users, as well as a suite of marketing tools to its clients that analyze behavior and optimize ads.

Metaverse startups

Facebook’s Mark Zuckerberg has bet his company’s future on virtual reality, and it may actually be justified. Covering everything from crypto and NFTs to digital fashion and gaming, the metaverse is a new frontier for capitalism.

And the revenue opportunity is incredible. Some analysts predict the market could approach $800 billion in 2024 and $1.6 trillion by 2030. This digital gold rush has already drawn the attention of major brands like Gucci, Nike, Coca-Cola, JPMorgan, and much, much more.

Some of the top-funded metaverse companies of 2022 were:

- Epic Games, the company behind Fortnite, with a $2 billion funding round

- eFuse, after locking down nearly $1 billion in VC funding

- Yuga Labs, thanks to a $285 million crypto sale and another $450 million in an Andreessen Horowitz-backed funding round

- NFT startup Immutable, bumping its valuation to $2.5 billion following a $200 million raise

- LincTex Digital, a metaverse fashion brand, with a $100 million raise

Biotech startups

Biotech startups

Biotech is an industry where biology and engineering meet to tackle some of the world’s most complex problems, from world hunger to quick pandemic responses. And if you thought the metaverse was a big opportunity, this sector could be even bigger.

Grand View Research sees the biotech market soaring to a valuation of $3.8 trillion by the end of 2023, reporting a CAGR (compound annual growth rate) of 13.9% over the forecast period.

While macroeconomic headwinds have weighed on biotech funding in 2022, the industry is promising.

Some of the most exciting new biotech trends that have emerged in recent years include:

- Genome surgery: or gene editing, is an emerging technology that can help prevent disease, save endangered species, and even create more resilient agriculture.

- Bioprinting: a type of 3D printing technology that can emulate the characteristics of natural tissue, creating the potential to produce human organs and more.

- Gene sequencing: is kind of like big data for biology in that it provides genetic information that will help medical professionals identify disease before it arises in an individual.

- Personalized medicine: a new take on medication, offering up a more personalized approach to take care of individuals’ needs.

- Biomanufacturing: a technology similar to bioprinting, except on a much larger scale. For example, this technology is being used to create artificial meat, a new food source that could pave the way for more sustainable agriculture.

Startup team trends

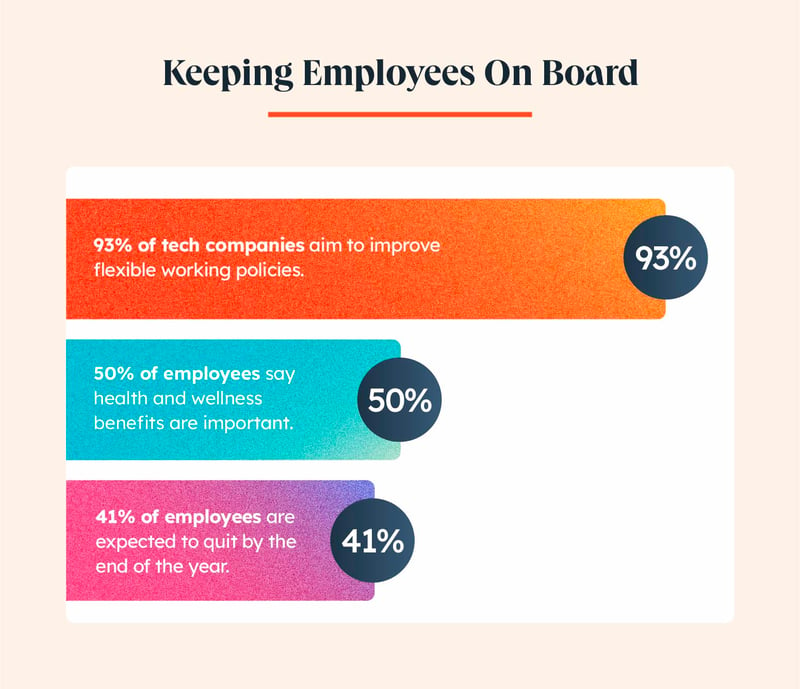

The Great Resignation took over headlines in early 2022. The buzzword stems from the World Economic Forum’s prediction that as much as 41% of employees would quit their jobs by the end of the year, and while quit rates are on the decline, it did have a significant impact on the workplace.

The “Big Quit” has been a driving factor in startups’ prioritization of employees’ health and wellness, improving culture in the workplace and the employee experience. It’s also pushed companies to lean more heavily on technology to measure everything from employee engagement and productivity to employee happiness and well-being.

Health and wellness

Health and wellness

The COVID-19 pandemic sparked a shift in priorities for employees and employers alike. As the world collectively reimagined what’s truly important in the workplace, health and wellness quickly stole the show. In many cases, a business’s approach to health and wellness will determine whether an employee stays or walks out the door.

Perhaps unsurprisingly to some, 47% of human resource leaders say employee retention is one of their biggest challenges, while the lack of work/life balance or career development are the top two reasons employees quit.

This is why as much as 93% of tech companies are improving flexible working policies and practices, and more than half are including benefits to manage mental and emotional health.

In response to these new workplace standards, more than 50% of all employers say health and wellness benefits will become increasingly important over the next three to five years.

Tech and data

Remote work has exploded over the last two years and isn’t going away anytime soon. As such, startups have leaned heavily on new technologies, from predictive analysis platforms to automation and artificial intelligence, to adjust to this new normal and create better workplaces.

As startups pile into new tech, the global HR software market is expected to grow by more than 100% from now through 2028.

Some of the things employers are focusing most heavily on are:

- Strategic workforce planning

- Analytics platforms

- Skill-building at scale

- AI-based productivity tools

These tools help employers utilize data to measure productivity, optimize rewards, identify pay inequality, improve efficiency, and much more — all while helping employees build skills and feel more empowered.

Upskilling and training

One of the most important factors that contributes to employee happiness is being given the opportunity to learn new skills.

This should be an easy win for any startup that cares to make an effort on this front, especially considering 98% of companies report significant skill gaps. Still, only 40% of employers are using targeted learning and upskilling to address skill gaps.

Offering training and personal development is an opportunity for employees to become more fulfilled in their positions and helps companies by filling their rosters with certified experts on any given subject.

This trend will likely take off as employers see these efforts paying off in the coming years.

ESG in the startup ecosystem

Environmental, social, and governance (ESG) is a trend that no one can ignore. In fact, entire venture capital firms and hedge funds have been created around ESG principles.

ESG is a way of measuring a company's impact on people and the planet, and it can make or break a startup’s chances of getting funded.

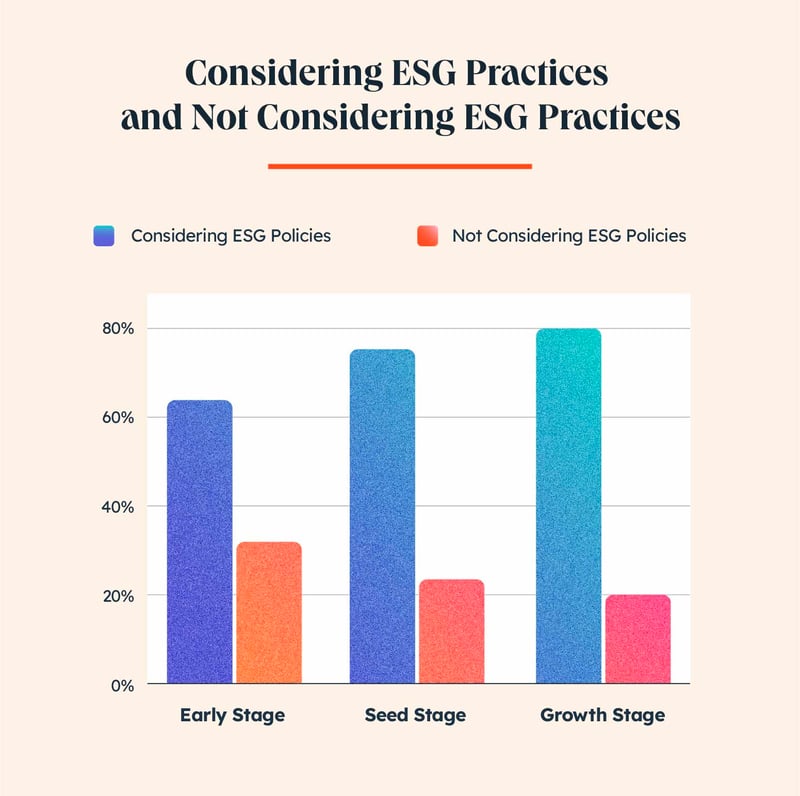

From seed-stage funding to growth-stage funding, venture capital firms are taking ESG considerations into account.

More and more startups are considering ESG practices when making business decisions. And it's not just because it's the right thing to do. There's also a growing body of evidence that shows that funds that prioritize ESG principles outperform those that do not.

Environmentally conscious

Disclosing things like environmental impact has not just become a standard practice for many companies — it could become mandatory.

For many investors, it is already a high priority.

SEC Chair Gary Gensler noted in early 2022 that investors managing over $130 trillion in assets are calling on companies to report their climate risks. And this trend isn’t likely to go quietly into the night.

Going into 2023, environmental impact is an increasingly hot topic as the energy crisis in Europe sparked by the war in Ukraine highlights exactly how delicate the energy ecosystem can be.

Social responsibility

Social responsibility is another growing trend in the startup ecosystem. Companies are no longer just about posting profits and increasing shareholder value; they’re now expected to give back, take care of their employees, and maintain an ethical supply chain.

Startups with strong policies that protect employees from misconduct, ensure nondiscriminatory hiring practices, and pay fair wages are not just being recognized, they are being celebrated among investors and consumers alike.

Startup governance

Governance, or a startup’s leadership, has also come under a microscope in recent years. Things that used to fly in the past are no longer tolerated.

Some key elements investors are taking into consideration include:

- Clean political track record: Companies should move away from donating to political candidates to receive preferential treatment.

- Accurate and transparent accounting: Companies must be open and honest in their financial reporting.

- Diverse leadership: Companies must provide equal opportunities across all levels, including management and executive leadership.

Diversity in startups

We're also seeing a trend of more diverse teams in startups. This is being driven by increased awareness of the importance of diversity and inclusion, as well as a desire to tap into new markets.

Some key elements investors are taking into consideration include:

- Racial diversity

- Gender diversity

- LGBTQIA+ inclusion

- Neurodiversity

Here are some quick facts of which you should take note:

- Funding for Black entrepreneurs in the first half of 2022 exceeded $1.8 billion

- VC deals by women-run businesses in 2022 exceeded pre-2021 levels

- Out of the $167 billion startups raised in 2020, only $3 billion went to Black or Latina women founders.

- Less than 1% of all funding goes to LGBTQIA+ founders.

These stats are particularly important because while white men only represent 30% of the population, they manage a shocking 93% of all VC dollars. This highlights a significant disconnect in opportunities in the startup ecosystem.

Trends in startup exits

Whether a startup is going public, getting acquired, or merging with another company, the exit can finally provide founders and shareholders a chance to cash in.

Going public

Going public is a huge deal for startups. It brings their company into the public light and opens up a whole new level of funding opportunities and, of course, scrutiny.

There are three primary ways to take a company public: an initial public offering, a special purpose acquisition company, and a direct listing. Each of these has its own set of benefits and challenges.

An initial public offering, or an IPO, is probably the most well-known method of taking a company public. Some of the benefits include a ton of media exposure and pricing guidance from top Wall Street banks, though they can be particularly costly.

Special purpose acquisition companies, or SPACs, are companies created to raise funds from an offering and use the funds for the purpose of acquiring another company. If the merger or acquisition fails to materialize, the proceeds from the offering are returned to shareholders.

A direct listing is an increasingly popular option for larger, more established companies. Direct listings help companies pay less money to lawyers and bankers while letting the market, rather than bankers, decide how their shares will be priced.

While the number of new public listings fell sharply in 2022, as much as 70% of executives and investors surveyed by Fenwick believe activity will rebound in the next two to five years, with sentiment favoring direct listings, in particular.

Acquisition

Acquisitions are the most common exit strategy for startups. The reason for this is that, while public offerings may lead to a bigger payday, acquisitions are less risky, and they can give the founder the opportunity to move onto other things.

Acquisitions also give investors and shareholders a clear picture of how much money they will receive and when they will receive it, while public offerings require a stakeholder to sell their shares at whatever price the market determines is fair.

When asked about long-term goals, half of startup founders said they aim to be acquired.

Merger

While mergers are similar to acquisitions, there are some differences to consider. Acquisitions involve a larger company taking over a startup and absorbing their processes, products, and often even talent into their business. Mergers, on the other hand, often involve two companies coming together to create an entirely different company.

Mergers are appealing to startups as an alternative to fundraising, allowing the company access to fresh talent and tech or the funds they need to advance their business.

Merger considerations are typically paid directly to shareholders. And unlike a stock sale, 100% of the interest of a company can be transferred without the consent of all stakeholders.

Exit trends by the numbers

Mergers and acquisitions are the most common, accounting for 2,502 exits in the first half of 2022, while public offerings, including SPAC offerings, accounted for just 156 of total startup exits.

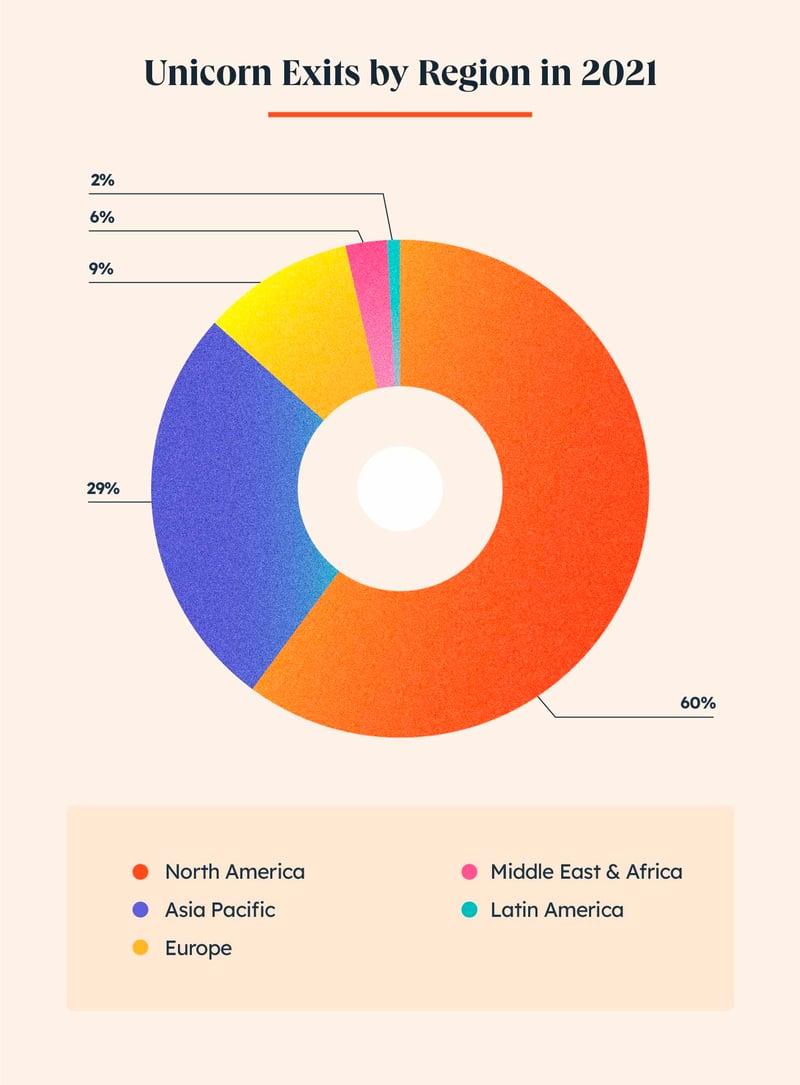

North America led the number of unicorn exits worldwide in the first half of 2021, with 182, while the Asia Pacific region accounted for 87.

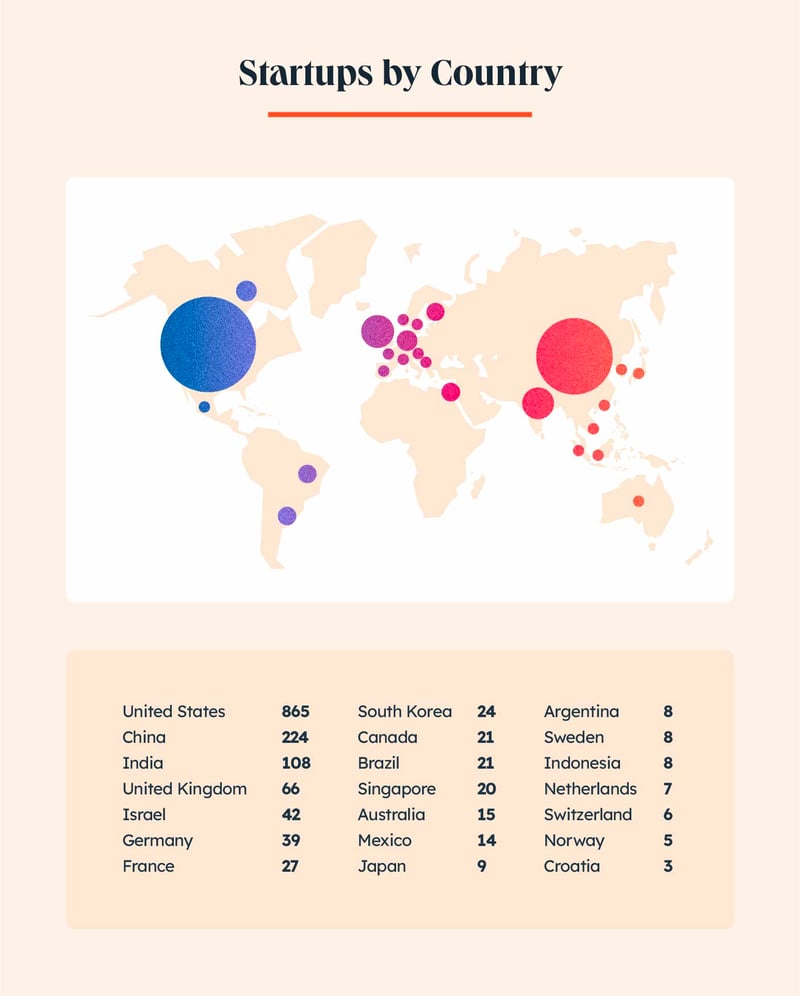

Best countries for a startup

The startup ecosystem is expansive and certainly not limited to just a handful of countries, though some do tend to outperform others. While the United States is unlikely to lose its position as the de facto startup capital of the world, it would be wise to keep an eye on China, especially after some key policy shifts earlier in 2022.

United States

The United States will likely remain a top destination for startups, thanks to its strong research and development capacity, friendly policies, and lots of funding opportunities.

Total funding in the United States in 2021 exceeded $108 billion, marking a 108% increase from the year prior.

The United States has minted a total of 865 new unicorns, and will likely lead the pack for some time to come.

United Kingdom

Like the U.S., the U.K. is very supportive of its startups, with a slew of grants, tax credits, and government initiatives to help aspiring entrepreneurs.

In the first half of 2022, U.K. startups raised more than $13.75 billion and hosted a total of 66 unicorns.

Israel

Israel is another heavy hitter in the global startup ecosystem, with fintech and cybersecurity leading funding in the country.

Israeli startups raised $10 billion in the first half of 2022, hosting a total of 42 unicorns.

Canada

Canada, like the United States and United Kingdom, has a vibrant startup ecosystem with supportive regulation and a number of government funding initiatives.

Despite the economic downturn, Canadian VC deals remained fairly strong through the first half of 2022, with the average deal sitting at $23 million. Canada is home to 21 unicorns.

China

China is a startup behemoth with a massive population and a $17 trillion economy. While there are a lot of opportunities for Chinese startups, especially in the technology sector, government oversight and censorship have historically been a thorn in domestic startups’ sides.

China has the world’s second highest number of unicorns at 162, and as its economy begins to bounce back and its government relaxes some of its strict regulatory scrutinies, this number could climb dramatically.

Conclusion

The macroeconomic environment in 2022 has certainly driven some of the major trends in the startup ecosystem, though there is a lot of promise, especially for innovative startups prioritizing people and sustainability.

Going into 2023, many of the trends you’ve seen this year are likely to persist. For many startups, it’s time to tighten the belt and get creative with fundraising.

While the economy is looking fairly gloomy for the foreseeable future, it’s not necessarily a bad time for startups to get some skin in the game. Learn about how HubSpot for Startups can help your business today. We’ve partnered with VCs, accelerators, incubators, and entrepreneurial organizations across the globe to help entrepreneurs go from early stage to public offering.